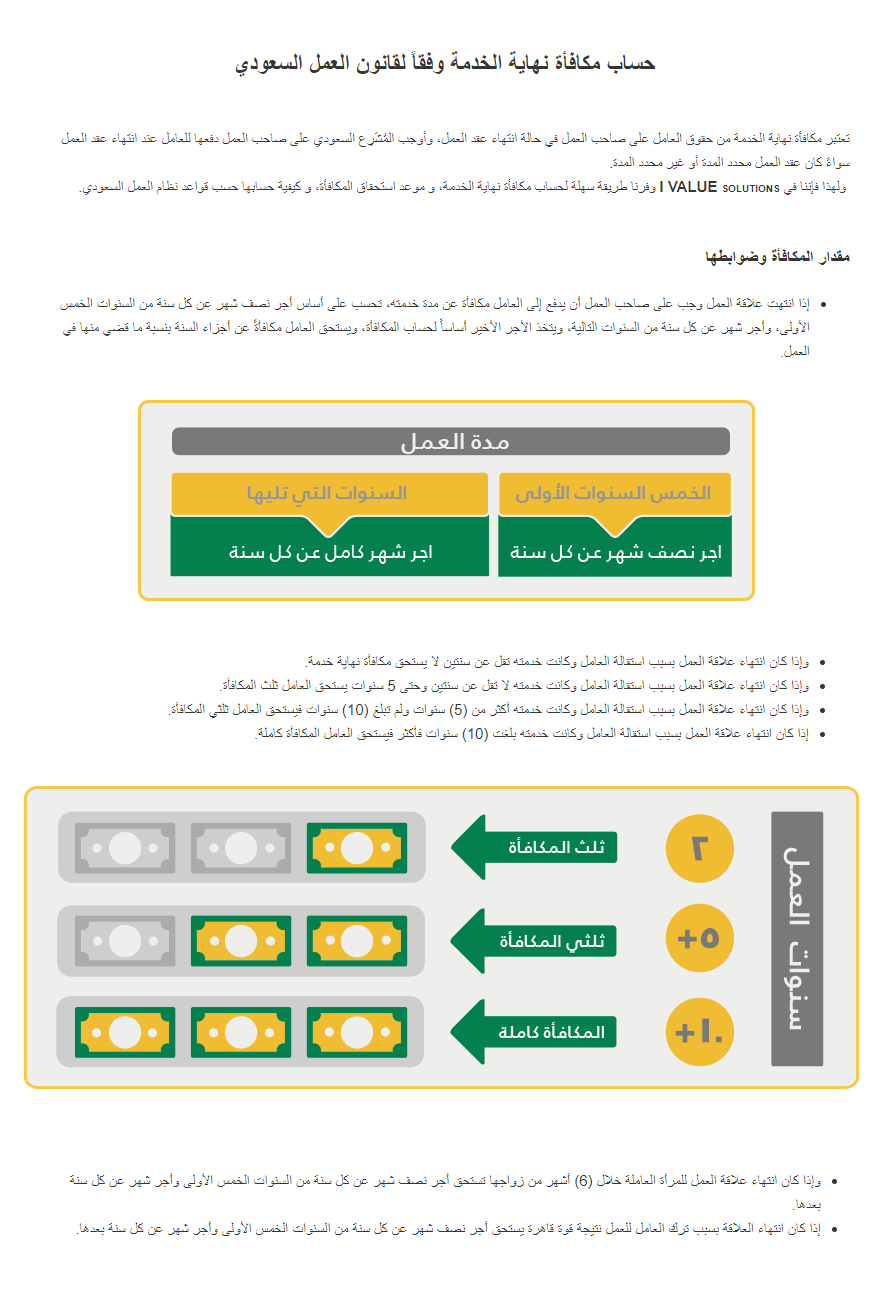

Calculate your employee END OF SERVICE reward, based on their hiring date and years of service, flexible calculation rules, with full approval cycle till payment.

Features:

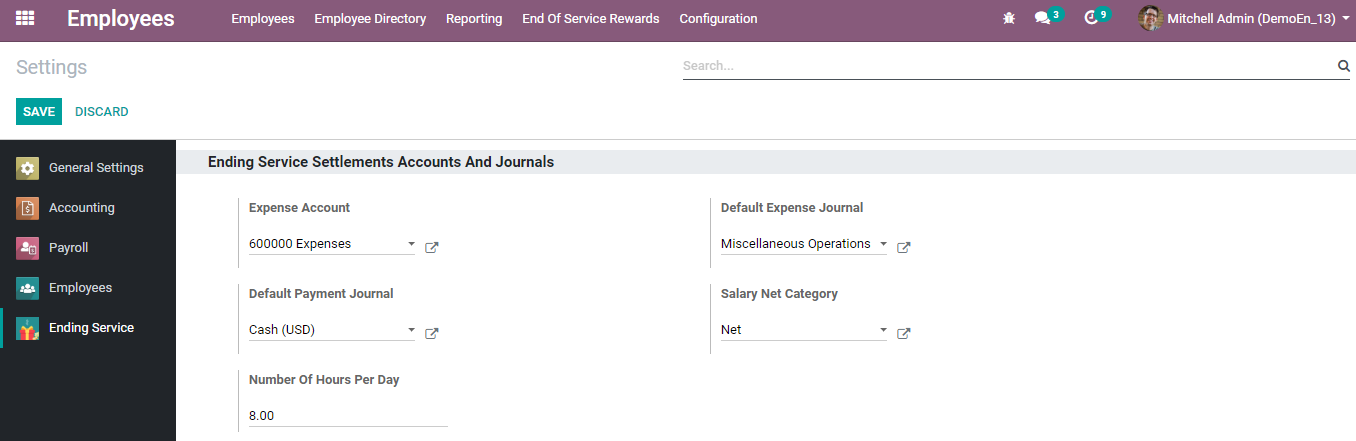

- Default setting (Expense Account, Payment, and Expense Journal).

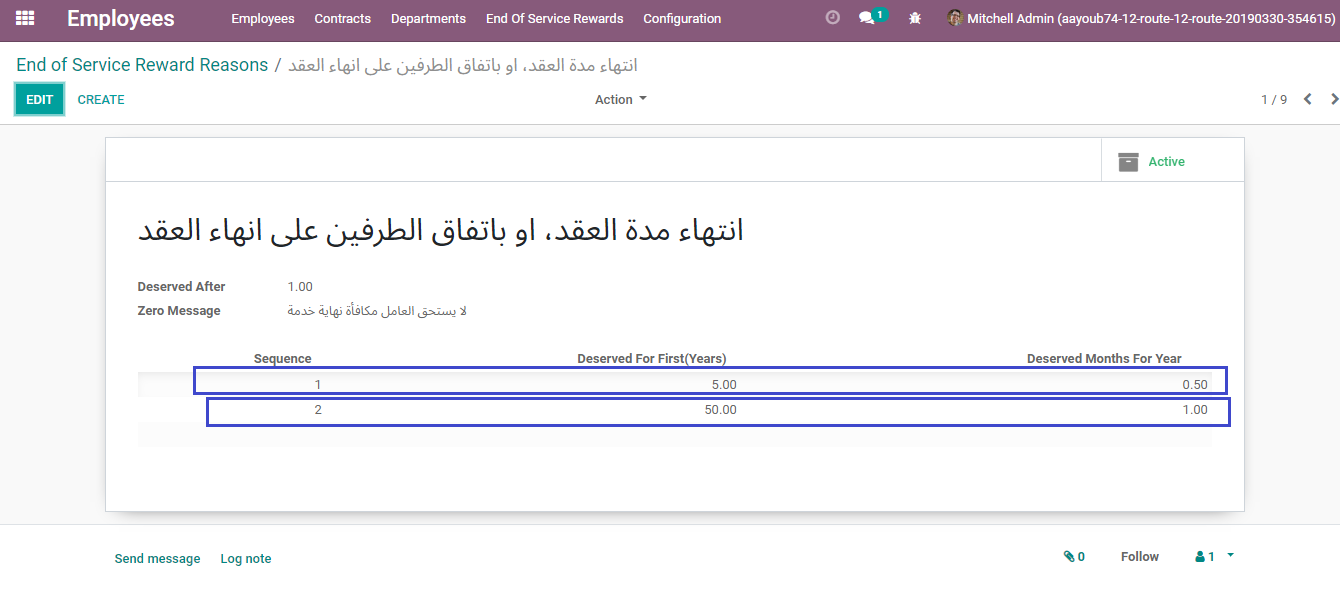

- 9 pre-defined Reason for Ending Employee Service.

- Multiple Allowances available for employee.

- Hiring date at Employee.

- Employee must have private address.

- Email to authorized users to approve and disburse.

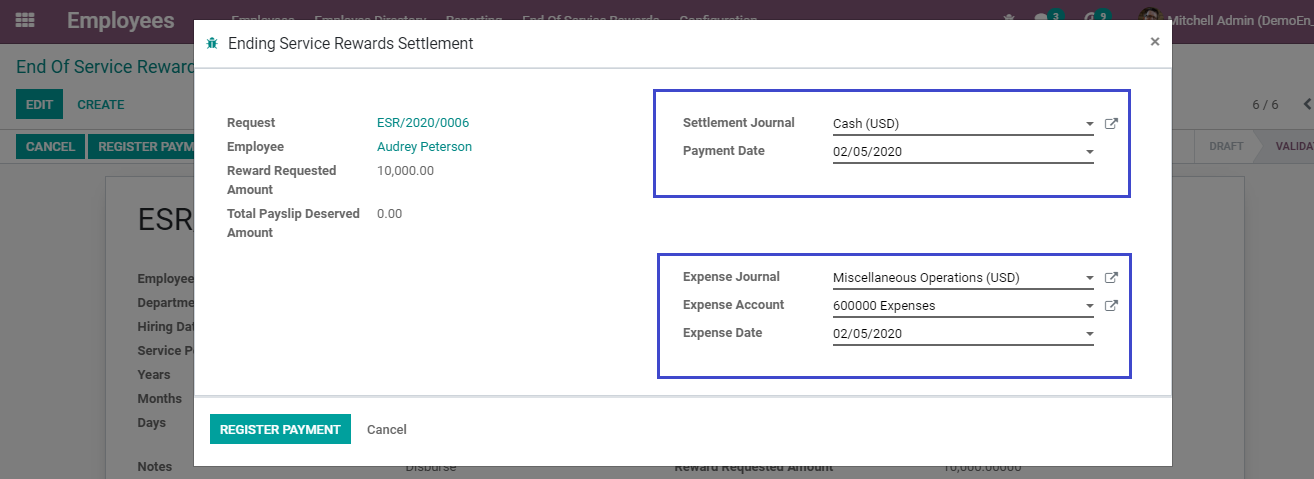

- Different dates for expense and payment.

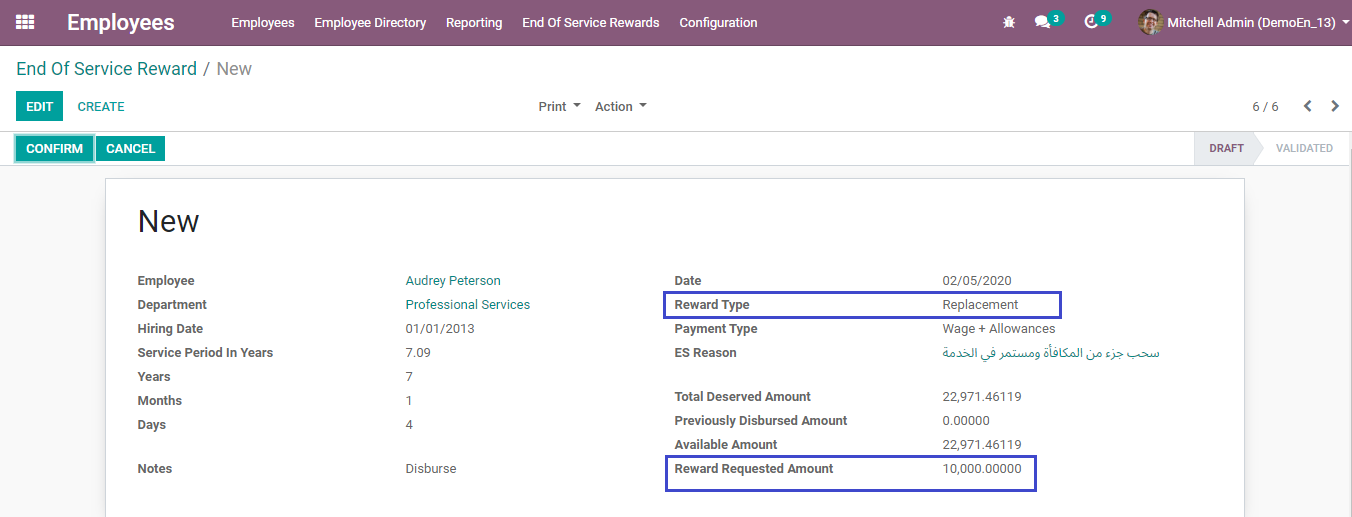

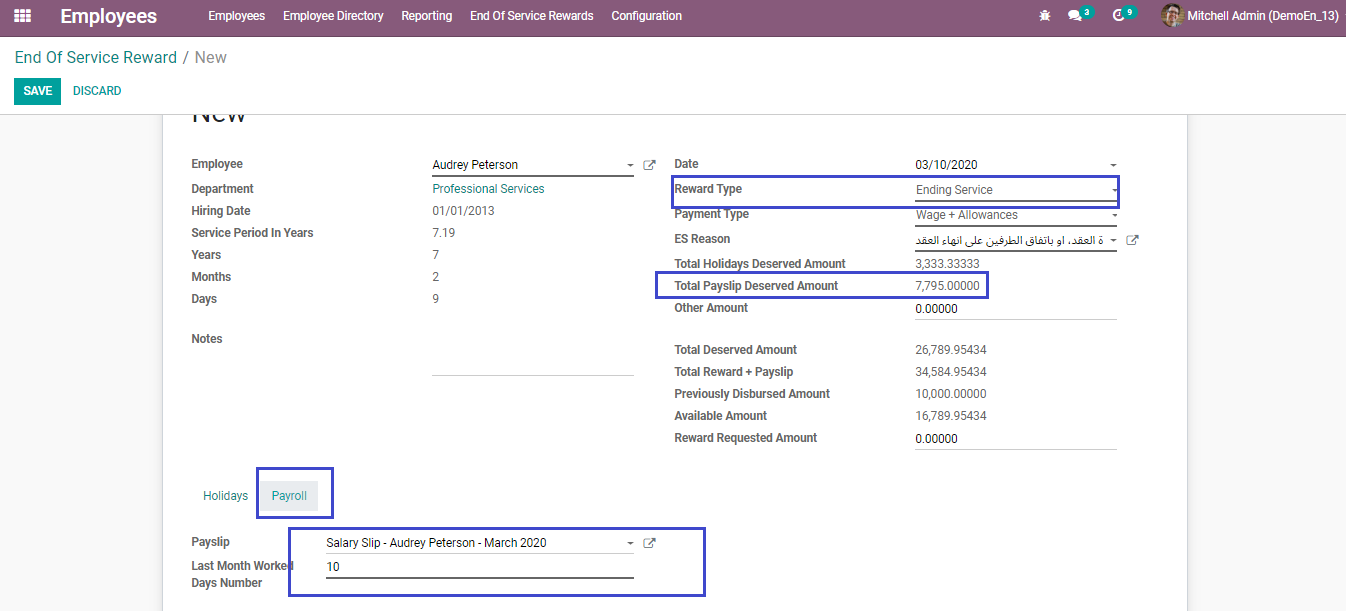

- You can link the last payslip to the request, and create different payment for it.

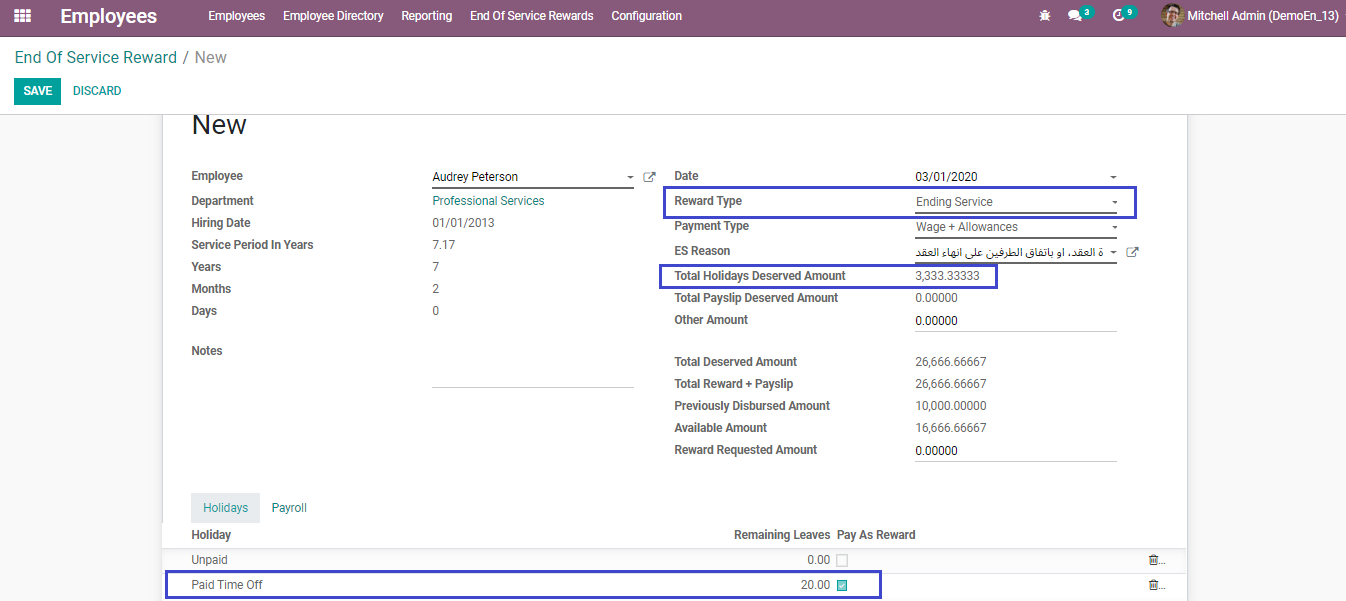

- You can link leave balances to the request and pay it as per the daily wage rate.

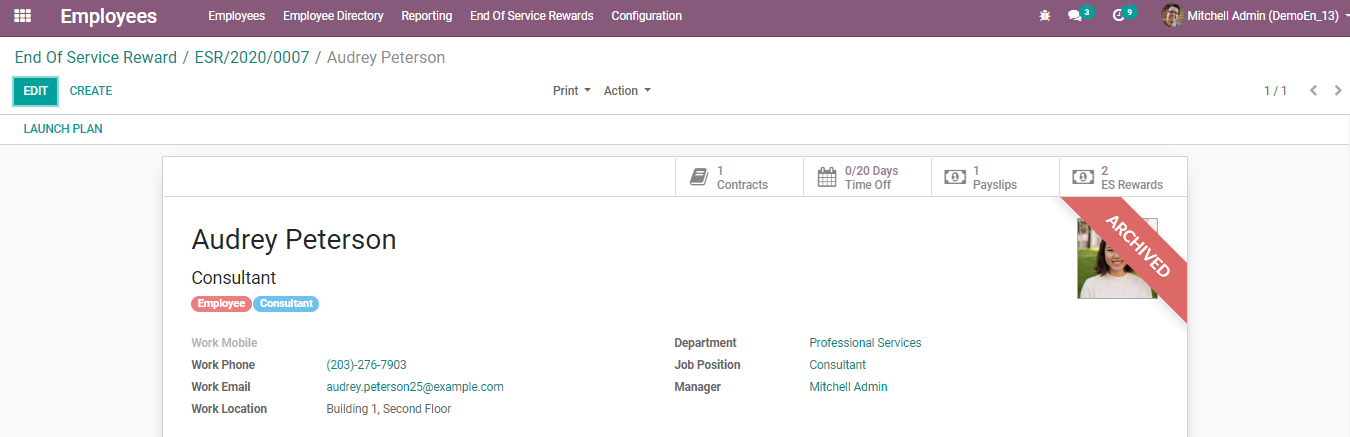

- Employee archiving and contract cancellation after request approval.

- Statement print.

- Graph and pivot reports.

Steps:

- Define your default expense account, expense journal, and payment journal.

- Choose the "Salary Net Category", this will take the amount on the net rule to disburse with the reward when the employee leaves.

- Private address must be added to employee private information.

- Hiring Date must be added to employee private information.

- Add allowances to your employee contract, every employee must have only one Running contract.

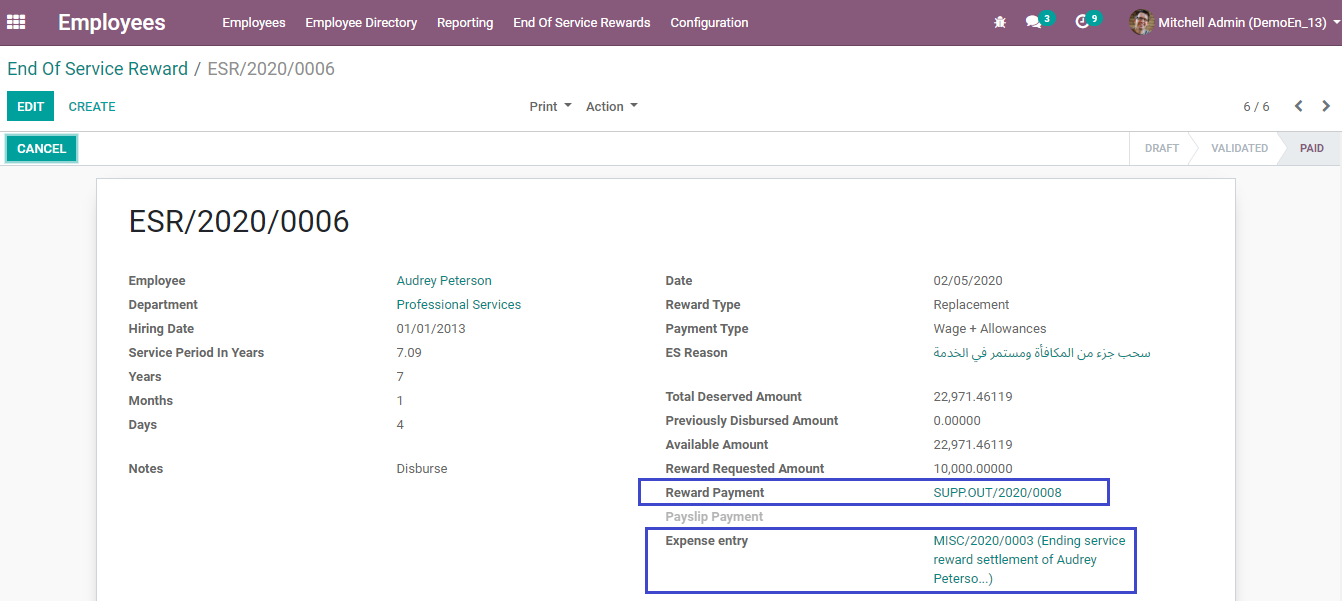

- Create ES request as HR Officer (email will be sent to HR manager).

- HR manager will approve (email will be sent to Accounting rule).

- Accountant will register payment and expense entry.

- Payment will be generated for employee, and journal entry for the expense.

- If the request type is "Ending Service" you can pay the leaves remaining balances to the employee as per the daily wage, also you can choose the last payslip issued for him/her to pay it with the reward.

- If the payslip will be paid, a separate payment will be generated for it.

- After confirming a request with type "Ending Service" the employee will be archived, and the contract will be cancelled.

# This module is for Enterprise version only as the CE version doesn't include payroll. If you need the Community version please contact us on our email below.

# This module is pre-defined based on KSA labor rules for ending employee services. However, it's applicable for any need as its rules are modifiable.

: Review the Demo video below

https://youtu.be/tWpxWDEzJZE

Thank You for Using I VALUE smart solution

Please contact us for any inquiries

info@ivalue-s.com

This software and associated files (the "Software") may only be

used

(executed, modified, executed after modifications) if you have

purchased a

valid license from the authors, typically via Odoo Apps,

or if you

have

received a written agreement from the authors of the

Software (see the

COPYRIGHT file).

You may develop Odoo modules that use the Software as a library

(typically

by depending on it, importing it and using its

resources), but

without

copying any source code or material from the

Software. You may distribute

those modules under the license of your

choice, provided that this

license

is compatible with the terms of

the Odoo Proprietary License (For

example:

LGPL, MIT, or proprietary

licenses similar to this one).

It is forbidden to publish, distribute, sublicense, or sell

copies of the

Software or modified copies of the Software.

The above copyright notice and this permission notice must be

included in

all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF

MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT

SHALL THE

AUTHORS OR COPYRIGHT HOLDERS

BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN

ACTION OF CONTRACT, TORT OR OTHERWISE,

ARISING

FROM, OUT OF OR IN

CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER

DEALINGS IN THE

SOFTWARE.

![Employee End Of Service Rewards [ESR]](/web/image/odoo.module.version/3479/image_1920/Employee%20End%20Of%20Service%20Rewards%20%5BESR%5D%20%5B14.0.0.2%5D?unique=6516ef5)